All about Vancouver Accounting Firm

Wiki Article

Fascination About Virtual Cfo In Vancouver

Table of ContentsThe Main Principles Of Small Business Accounting Service In Vancouver The 30-Second Trick For Cfo Company VancouverSome Of Tax Accountant In Vancouver, BcThe Of Tax Accountant In Vancouver, BcThe Best Strategy To Use For Tax Consultant VancouverNot known Facts About Outsourced Cfo Services

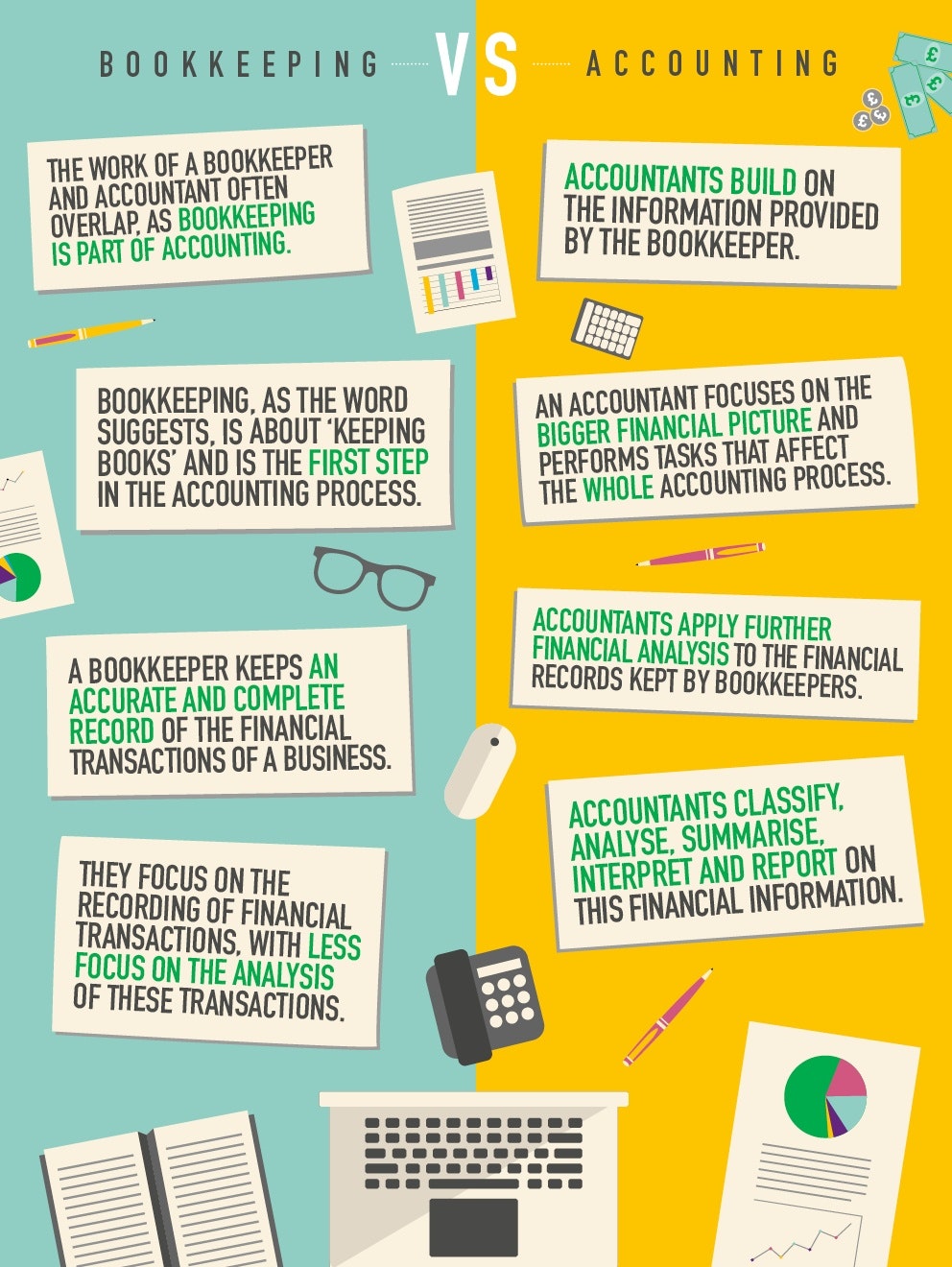

Here are some advantages to working with an accounting professional over a bookkeeper: An accountant can offer you a thorough sight of your organization's economic state, in addition to approaches and also recommendations for making financial decisions. On the other hand, accountants are only in charge of taping monetary deals. Accounting professionals are needed to finish more schooling, qualifications and work experience than bookkeepers.

It can be challenging to determine the appropriate time to work with an accounting expert or accountant or to determine if you require one whatsoever. While numerous small companies hire an accounting professional as a specialist, you have a number of options for taking care of monetary tasks. As an example, some tiny business owners do their very own accounting on software application their accountant advises or makes use of, giving it to the accounting professional on a regular, monthly or quarterly basis for activity.

It might take some background research study to find a suitable accountant because, unlike accountants, they are not needed to hold a specialist qualification. A strong endorsement from a trusted coworker or years of experience are vital factors when hiring an accountant.

The Best Guide To Vancouver Tax Accounting Company

For local business, experienced cash money monitoring is a vital element of survival as well as development, so it's smart to deal with an economic expert from the start. If you like to go it alone, think about beginning out with bookkeeping software program and also maintaining your publications meticulously as much as day. In this way, must you need to employ a professional down the line, they will certainly have visibility right into the complete economic history of your company.

Some source meetings were conducted for a previous variation of this article.

Not known Facts About Outsourced Cfo Services

When it concerns the ins and also outs of tax obligations, accountancy and money, nevertheless, it never ever hurts to have a seasoned professional to rely on for support. An expanding variety of accounting professionals are likewise dealing with things such as cash circulation estimates, invoicing and HR. Eventually, a number of them are handling CFO-like roles.As an example, when it came to making an application for Covid-19-related governmental financing, our 2020 State of Small Company Research Study found that 73% of local business proprietors with an accountant claimed their accounting professional's advice was essential in the application procedure. Accounting professionals can additionally assist entrepreneur stay clear of expensive errors. A Clutch study of local business proprietors programs that more than one-third of small companies list unanticipated costs as their leading financial obstacle, complied with by the mixing of business and also personal finances as well as the failure to obtain repayments in a timely manner. Local business owners can expect their accounting professionals to aid with: Choosing the service structure that's right for you is essential. It influences exactly how much you pay in tax obligations, the documents you need to submit and also your personal obligation. If you're wanting to convert to a different company framework, it could cause tax obligation repercussions and also various other issues.

Also firms that are the same size and also industry pay very various amounts for accounting. These expenses do not transform into money, they are essential for running your service.

The Facts About Vancouver Tax Accounting Company Revealed

The ordinary expense of audit solutions for small company differs for every special circumstance. Since bookkeepers do less-involved tasks, their rates are frequently cheaper than accounting professionals. Your monetary service charge depends upon the work you need to be done. The typical month-to-month bookkeeping charges for a local business will climb as you add a lot more services and the jobs obtain harder.You can tape-record transactions and procedure pay-roll using on-line software. You go into amounts into the software program, as well as the program calculates totals for you. In many cases, payroll software for accountants permits your accountant to offer pay-roll processing for you at very little added expense. Software application solutions come in all forms as well as sizes.

Little Known Facts About Small Business Accountant Vancouver.

If you're a new service owner, do not forget to variable audit expenses right into your budget plan. If you're a veteran owner, it could be time to re-evaluate audit costs. Management prices as well as BC accountant fees aren't the only bookkeeping expenditures. small business accountant Vancouver. You ought to also consider the impacts audit will have on you as well as your time.Your ability to lead employees, serve clients, and choose might endure. Your time is also important and should be thought about when considering bookkeeping costs. The time spent on bookkeeping jobs does not generate revenue. The less time you invest on bookkeeping and tax obligations, the even more time you have to grow your service.

This is not intended as lawful suggestions; for more information, please go here..

Not known Incorrect Statements About Virtual Cfo In Vancouver

:max_bytes(150000):strip_icc()/accountant-job-description-4178425-edit-01-fe86b64141eb44498c11502dcb2440c0.jpg)

Report this wiki page